Retirement Plan Contributions

The IRS announced the amount individuals can contribute to their 401(k) plans in 2025 has increased to $23,500, up from $23,000 for 2024.

The IRS announced the amount individuals can contribute to their 401(k) plans in 2025 has increased to $23,500, up from $23,000 for 2024.

Auditors of employee benefit plan financial statements have new performance requirements. Employee benefit plan administrators and those charged with governance should become familiar with the new requirements.

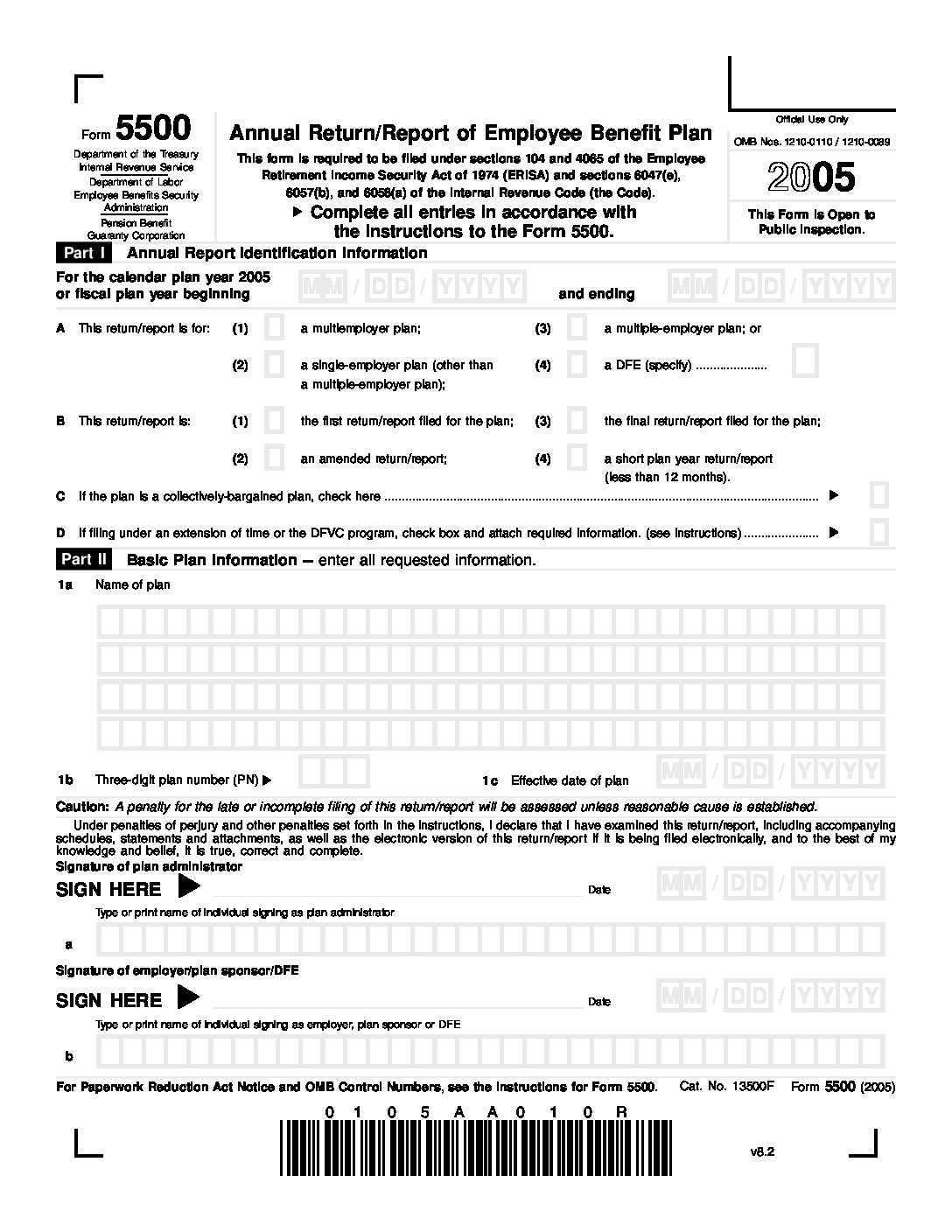

Sponsors of retirement plans are required by law to report information to the IRS, the Department of Labor (DOL), and Pension Benefit Guarantee Corporation (PBGC). Your plan type, business size, and circumstances affect the type of information, forms, and disclosure requirements.

Recent government aid in the face of COVID-19 extends beyond tax breaks. It also includes provisions for various aspects of retirement plans.

According to Eric Stevenson, President, Nationwide Retirement Plans, advisors to retirement plans will play a critical role, stating “This is the time they have to be more visible than they have ever been,” said Stevenson. “They have to be in constant communication with plan sponsors, even if from a distance.”